-40%

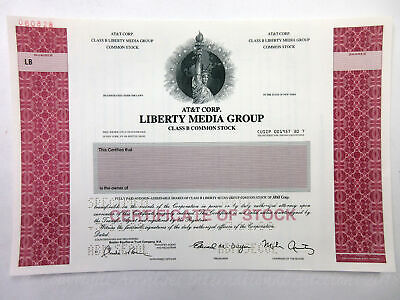

NY. AT&T Corp. - Liberty Media Group, 1999 Odd Shrs Specimen Stock Cert, XF ABN

$ 25.86

- Description

- Size Guide

Description

Click image to enlargeDescription

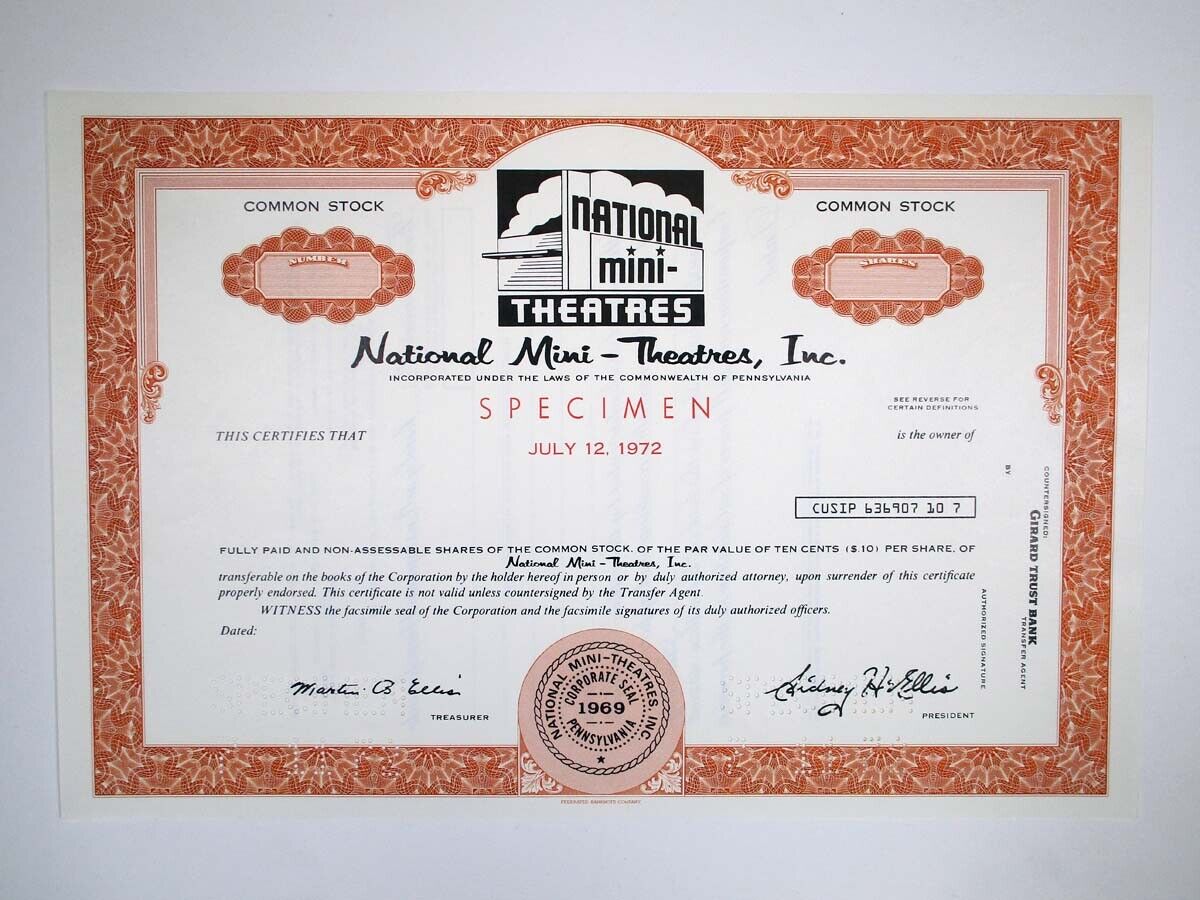

NY. AT&T Corp. - Liberty Media Group, 1999 Odd Shrs Specimen Stock Cert, XF ABN. Liberty Media produces, acquires, and distributes entertainment and informational programming services, as well as electronic retailing services, through subsidiaries and affiliates. Such programming is delivered to viewers in the United States and overseas via cable television and other distribution technologies. In 1999 the American Telephone and Telegraph Company, an integrated telecommunications services and equipment company known as AT&T, purchased TCI for billion, folding TCI Ventures into Liberty Media, as well as parts of Sprint PCS, United Video Satellite Group (Gemstar-TV Guide), General Instrument, and TCI International. This combination known as Liberty Media Group and headed by Chairman Malone added assets in technology, wireless telephone and international cable and programming businesses. Liberty Media's interest in FOX/Liberty Networks was traded for an 8 percent interest in News Corporation. Purchased the same year were Associated Group, a wireless communication services and radio broadcasting company, and a stake in Teligent, a wireless communications company. In 2000, Liberty Media invested in Cendant Corporation, a worldwide provider of travel, real estate, vehicle, and financial services; PRIMEDIA, a magazine publisher and specialty video producer and distributor; and Corus Entertainment, a Canadian media group; Todd-AO, an Atlanta-based company specializing in motion picture and television post-production, renamed Liberty Livewire; and Denver's Ascent Entertainment Group, a multimedia distribution and entertainment service provider specializing in satellite distribution support services. Other transactions in 2000 included folding Liberty Media's European and Latin American broadband assets into UnitedGlobalCom (UGC) and merging Japan-based Jupiter Telecommunications, of which Liberty Media owned 50 percent, with Microsoft's Titus Communications. An 11 percent equity stake in France's UGC had been purchased in the fall of 1999, with additional interests acquired in 2002. UGC was the largest operator of cable television systems outside the United States. In November 2000, AT&T announced that Liberty Media Group would be one of four planned spin-offs as the company was restructured into separate cable, wireless, corporate and consumer businesses. In February of the following year, Liberty Media filed a .4 initial public offering (IPO), the largest in IPO in history. The spin-off, completed on August 10, 2001, enabled Liberty Media to begin trading as an independent publicly-traded company, to raise capital on its own, and to use its stock as currency in acquiring, merging, or partnering with other companies. Each outstanding share of AT&T Class A Liberty Media Group tracking stock was redeemed for one share of Liberty Series A common stock and each outstanding share of AT&T Class B Liberty Media Group tracking stock was redeemed for one share of Liberty Series B common stock. Common stock began trading on the New York Stock Exchange under the symbols LMC.A and LMC.B. Prior to the spin off, BET Holdings was acquired by Viacom, Inc., in exchange for 15.2 million share of Viacom's common stock. In an effort to expand their European activities and control by ownership a large European cable television business on which to build other businesses, Liberty Media attempted to acquire six of the nine regional cable television companies in Germany. German anti-trust authorities turned down the proposed acquisition. The company did not appeal the decision. In December 2001, Liberty Media exchanged their 21 percent interest in Gemstar-TV Guide International for News Corporation shares, making them a leading shareholder with an 18 percent interest in the company. Another agreement in 2001 allowed Liberty Media to exchange a portion of their interest in USA Networks Inc. and certain other assets for shares in Vivendi Universal as part of a larger transaction between USA and Vivendi. Liberty Media agreed to sell Telemundo to General Electric's NBC for .2 billion.

Payment

Please contact us if you would like to pay by VISA, Master Card, or Discover Card.

Shipping

Shipping: .50 Insured in the U.S. only

Price will be reduced based on value and size of item (s)

Overseas: .50 Registered Mail

(We will combine purchases)

About Us

PLEASE CONTACT US BEFORE GIVING NEGATIVE DETAILED SHIPPING FEEDBACK IF THERE IS ANY QUESTION OR ISSUES WITH SHIPPING PRICES. WE ARE NOT TRYING TO MAKE MONEY ON SHIPPING, SO IF YOU FEEL THE PRICE IS UNFAIR, PLEASE LET US KNOW.

WE STRIVE TO OFFER EXCEPTIONAL SERVICE AND HOPE TO HAVE YOU AS A REPEAT BUYER. IF THERE IS ANYTHING WE CAN DO TO SATISFY YOU WITHIN REASON, WE WILL MAKE OUR BEST EFFORT TO ACCOMPLISH THIS.

THANK YOU FROM THE TEAM AT ARCHIVES INTERNATIONAL

Contact Us

Feel free to reach out to us if you have any questions.

Phone Number: +1 (201) 944-4800

Get images that

make Supersized seem small.

Showcase your items with Auctiva's

Listing Templates!

THE simple solution for eBay sellers.